Top risks facing community service providers

Community service providers are the heartbeat of our neighborhoods. Whether you run a daycare, manage a non-profit, offer counseling, or organize summer camps, your work

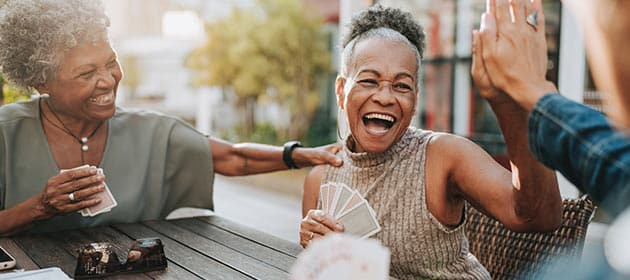

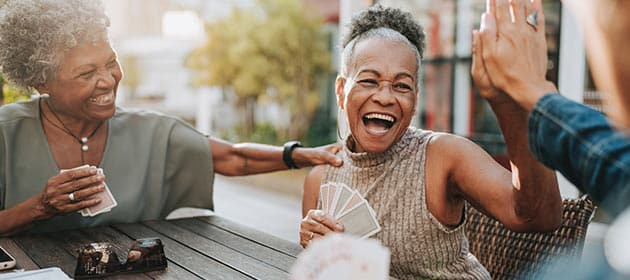

As an assisted living facility, you provide fundamental care to people whose age, health, or abilities have resulted in them relying on you and your business for help. Whether you manage daily living support, specialized care, or recreational programs, your business faces a unique set of risks.

We offer tailored business insurance policies designed to address sensitive concerns like cyber breaches and safeguard your facility from other liabilities, like equipment breakdown or professional liability.

Your business helps foster a stronger and safer community whether you operate a long-term care facility, senior care facility, or retirement home. Although, just like any other business there are risks that can come up in your day-to-day operations. We understand the unique challenges your business may face while providing specialized care and support. As your business evolves, we’re here to help you make informed decisions on how to protect your employees and the residents who depend on you. Providers we can provide coverage for include:

Assisted living and specialized care is all about people – the residents or patients that depend on your care and the dedicated staff who provide it. In the unforeseen event of loss or damage, it’s essential that your facility can resume operations quickly, as the support and services your business provides are vital. Here are some key coverages to consider for your facility’s protection:

If a resident or visitor were to slip, fall, and sustain an injury at your facility, you could be held liable and responsible for their compensation. Commercial general liability (CGL) insurance is designed to support you in such situations and can help cover substantial legal fees. This coverage can help protect your business if a third party experiences bodily injury or property damage on your premises or wherever your services are provided.

Severe weather, such as heavy rain, can cause significant damage to your assisted living facility. Commercial property insurance is designed to help cover the costs of property damage or loss, including repairs or replacement of essential equipment, furnishings, and even the building itself, ensuring your facility can continue providing care without disruption.

If an employee at your assisted living facility is involved in an accident while using a company vehicle, their personal auto insurance won’t cover the damages. Commercial auto insurance is designed to support you in these situations, helping cover injuries to drivers and passengers, costs for a replacement vehicle, and even lost wages resulting from a covered accident, ensuring your operations can continue smoothly.

Our underwriting team understands the exposures in the healthcare sector, so we can adapt and expand our offerings as our customers’ needs grow.

On top of our comprehensive core coverage and exceptional customer service, your business insurance policy grants you access to our Assist Services* for extra peace of mind.

With robust expertise in the assisted living, senior care, and retirement home industry, our Northbridge Risk Services team provides professional guidance and innovative strategies to help you manage risks effectively. Each year, we conduct over 5,000 risk assessments and service calls for businesses across Canada, including assisted living facilities. Our onsite assessments are paired with comprehensive training programs and educational tools designed to help your business thrive.

Our Risk Services team also offers technical publications to help you better understand the unique exposures in your industry. Additionally, they provide personalized guidance to fine-tune your daily operations and enhance safety for both residents and staff. Discover how our risk management experts can support your facility today.

Community service providers are the heartbeat of our neighborhoods. Whether you run a daycare, manage a non-profit, offer counseling, or organize summer camps, your work

Preventing a loss may seem like common sense, but there’s more to it than you might imagine. When it comes to having a strong loss

The effects of flooding can be greatly reduced by taking preventative and precautionary measures. We’ve put together a comprehensive list of things you can do

* Legal Assist not provided for criminal, personal or insurance issues, do not provide representation in legal proceedings or legal fees coverage, and provided by Assistenza International, through lawyers licensed in your jurisdiction. Risk Management Assist provided by our Risk Services specialists and are intended to augment your internal safety, compliance and risk management practices, and are not a substitute for professional or legal advice. Trauma Assist provided by independent third-party professionals, long-term and specialized counseling not included. Cyber Assist is provided by an independent third-party service provider. Services are not included in any cyber extension or endorsements. Services are not an insurance policy, not all policies are eligible, contact us for details.