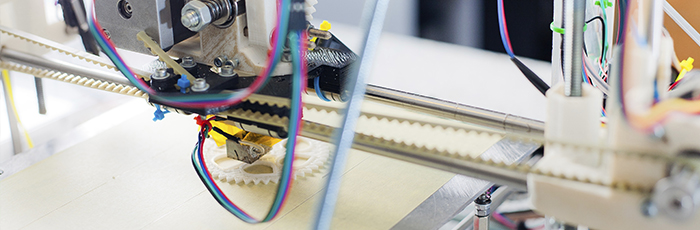

Thanks to automation and technological advancement, businesses in the Canadian Manufacturing sector are constantly evolving and innovating. The latest buzz topic? 3D printing.

While the technology isn’t exactly new, changes in hardware, software and materials have made Additive Manufacturing (otherwise known as 3D printing) both affordable and accessible. 3D printing is empowering small- and medium-sized firms in the manufacturing industry to venture into whole new lines of business and implement entirely different processes. From electrical wires to prosthetics, 3D printing is enabling the affordable launching of novel products, rapid production of moulds and dies, and easy prototyping and distribution.

What does this have to do with your insurance?

Additive manufacturing has and will continue to change – not only the industry, but also the liability exposures facing manufacturers. Manufacturers who adopt this technology may not be aware of the increased risks associated with implementing 3D printing as part of their operations. Your business may face increased risk of worker and public injury, fire exposure, intellectual property rights infringements, or product liability issues, just to name a few.

So how can you protect yourself?

Understanding and preparing for these risks is the first step. As the industry evolves and new electronic equipment and processes are introduced, it is more and more important to be sure that you are covered for related exposures, such as:

- Equipment breakdown

Coverage that mitigates financial losses caused by accidental breakdown to named pieces of equipment. - Professional indemnity

Coverage for alleged failure to perform on the part of, financial loss caused by, and error and omission in the service or product sold by the policyholder. - Product recall

Coverage in the event that a product is recalled after the discovery of safety issues or product defects that might endanger the consumer or put the maker/seller at risk of legal action. - Business interruption

Coverage for the loss of income that a business suffers after a catastrophe while its facility is either closed or in the process of being rebuilt. - Cyber risk

Coverage for first- and third-party losses resulting from network security breach, privacy breach and Internet media liability.

With so many variables, it’s important to discuss with your broker exactly what role 3D Printing plays in your operations, so you can be sure you have the right coverage.