Equipment breakdown insurance is a specialized coverage designed to protect businesses from the financial impact of sudden and accidental equipment failures. This includes breakdowns due to mechanical issues, electrical surges, or operator errors that are not typically covered under standard property insurance policies.

In today’s technology-driven business environment, equipment is integral to daily operations. From HVAC systems and refrigeration units to computers and production machinery, a single malfunction can halt operations, leading to significant financial losses. For instance, a manufacturing plant experiencing a motor burnout in a critical machine may face halted production. Equipment breakdown insurance can help cover the motor’s replacement and the income lost during downtime.

Why standard property insurance isn’t enough?

While commercial property insurance covers damages from external events like fires or storms, it often excludes internal equipment failures. For instance, if a power surge damages your computer system or if a mechanical failure stops your production line, standard property insurance may not cover the repair costs or the resulting business interruption.

Equipment breakdown insurance fills this gap by covering:

- Repair or replacement costs for damaged equipment

- Business interruption losses due to equipment failure

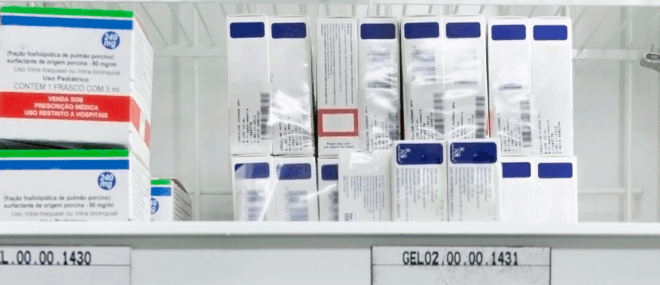

- Spoilage or perishable goods resulting from equipment malfunction

- Additional expenses incurred to expedite repairs

Consider a restaurant where a refrigeration unit fails overnight, spoiling inventory. The insurance will help cover both the repair of the unit and the cost of the spoiled goods.

Benefits of equipment breakdown insurance

- Comprehensive protection: Covers a wide range of equipment, including electrical, mechanical, and pressure systems.

- Financial security: Mitigates unexpected repair costs and business interruption losses.

- Quick recovery: Ensures fast recovery from equipment failures, maintaining business continuity.

Is this coverage right for your business?

If your operations rely on equipment – be it computers, machinery, or HVAC systems – equipment breakdown insurance is essential. It’s particularly crucial for industries like manufacturing, hospitality, healthcare, and retail, where equipment uptime is vital.

Even if your equipment is under warranty, such warranties often don’t cover business interruption losses or expedited repair costs. Equipment breakdown insurance provides a more comprehensive safety net.

Protect your business with insurance

Unforeseen equipment failures can disrupt operations and impact your bottom line. With Northbridge Insurance’s equipment breakdown coverage, you can safeguard your business against such risks. To learn more about how we can help protect your business, visit our Machinery and Equipment Manufacturers’ Insurance page.